Financial professionals are bombarded with broker-dealer buyouts that ultimately sound great...

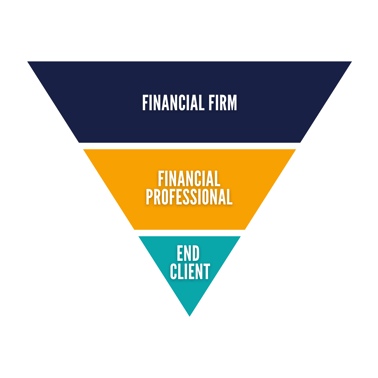

The Hierarchy of Decision-Making: What Most Financial Firms Get Wrong

.png?width=960&height=540&name=Untitled%20design%20(13).png)

Financial professionals are bombarded with broker-dealer buyouts that ultimately sound great financially, but come with dozens of hidden costs.

When it comes to making decisions – about technology, investment products, or any other service, solution or recommendation a financial firm is going to offer – there are three distinct parties that need to be considered: the end client, the financial professional, and the firm itself.

In our industry, with mergers and acquisitions, venture capital and private equity running rampant, decision-making about technology, products and services has taken a top-down approach.

Decisions are controlled by the firm (in most cases, the firm’s board of directors) and often made in the best interests of the firm, or the firm’s bottom line, with the needs of the financial professional and the end client in distant second and third place.

In this order, financial professionals are hamstrung by the recommendations and decisions they’re allowed to make in the best interests of their end clients, which in turn limits the success of and value provided to the clients.

A prime example of this is the fall from grace of commissioned insurance products. In many cases, these products aren’t very lucrative for the firm itself. So what happens? Firms put compliance regulations, internal red tape, and other complex barriers in place to prevent financial professionals from recommending them.

But the truth is, they can be extremely beneficial to the end client, offering protection from risk, tax benefits, and the potential for investment growth. Shouldn’t that be the main consideration?

Consider also the evolution from selling industry products like annuities to building in-house Unified Managed Accounts (UMAs) or plugging into Turnkey Asset Management Platforms (TAMPs) to offer investment options to clients.

While UMAs and TAMPs afford financial firms more efficiency and cost savings, they often come with higher fees that advisors either absorb or pass on to the end client, neither of which is ideal. They’re also limited in flexibility, possibly preventing financial professionals from recommending the investment options that would truly be the best fit for their clients. Once again, the firm is the main beneficiary of this model, with financial professionals and end investors lower in the hierarchy.

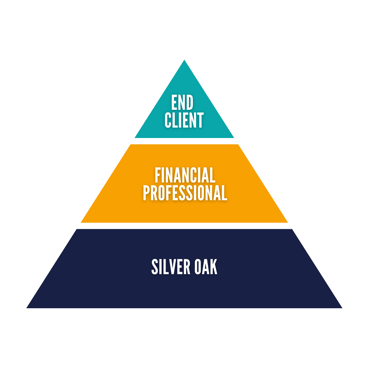

At Silver Oak, we’ve always believed the order of importance to be the inverse, with the end client as the primary benefactor of the decisions we make, the financial professional receiving the power, flexibility and autonomy to make recommendations in their clients’ best interests, and Silver Oak operating with the understanding that when we build our business with our clients and financial professionals top of mind, we win, too.

When our end clients thrive, our reps thrive. And when our reps thrive, so does Silver Oak. It’s why we marry the flexibility of independent advice with broker-dealer products and access to compliance expertise, to enable our financial representatives to do the work they know is best for their clients.

-1.png)

-3.png)